2 levels of the CFA in, I’m still not sure if I should be saying “indexes” or “indices”. Anyways. I worry about concentration in the market cap weighted index. As of this writing, the top 10 constituents in the iShares S&P 500 ETF, IVV, is about 33.5%, suggesting top heavy conentration. But it goes further than that. Apart from Eli Lilly and Berkshire Hathaway, all the other holdings are in the tech space. Many of the largest companies by market cap also seem tied to the AI trade– Alphabet, Microsoft, Nividia and Apple. Now, while they’re obviously high-tech businesses that have had widespread success, should AI turn out to be less profitable than what is implied by today’s sky-high valuations, I imagine these stocks could go down together.

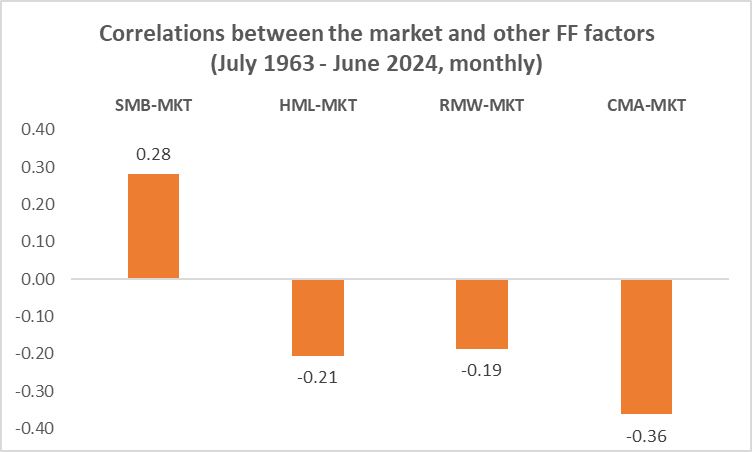

What I’m getting at is that beta is a concentrated bet these days. Even if you buy the ACWI, for instance, you’re still looking at a fifth of your portfolio in top names. One of the appeals of a factor tilted portfolio is that you’re getting exposure to (hopefully) positive risk premia that are independent of the market. Below, I’m taking a look at the correlations between the market and the other Fama-French factors (Size/SMB, Value/HML, Operating Profitability/RMW and Investment/CMA). As shown by the chart below, apart from the positively correlated size factor, the other factors have somewhat negative correlations to the market.

In other words, they can potentially act as a source of diversification. Just thinking of recent times, I was happy to be overweight on value stocks in 2022, which didn’t really lose a whole lot of money as tech stocks saw their multiples compress (but yes, being overweight value in 2020 wasn’t a whole lot of fun). People tend to factor tilt their portfolios because they view it as an increased source of expected returns. I’ll take all the extra return I can get, but particularly in a world of highly concentrated indexes, I’ll appreciate the potential for diversification as well.