Real return bonds; a great inflation hedging tool, right? TIPS, real return bonds or their equivalents in other countries typically have coupons that are indexed to some benchmark rate of inflation such as the CPI. It’s not uncommon to see the term “hedge” thrown around when it comes to these kinds of securities (Blackrock, for instance, suggests that TIPS are a hedge). Call this a pet peeve of mine, but inflation adjusted government fixed income is not a “hedge”. It is a security that does better than traditional fixed income during inflationary periods, all else equal. But it is not a hedge.

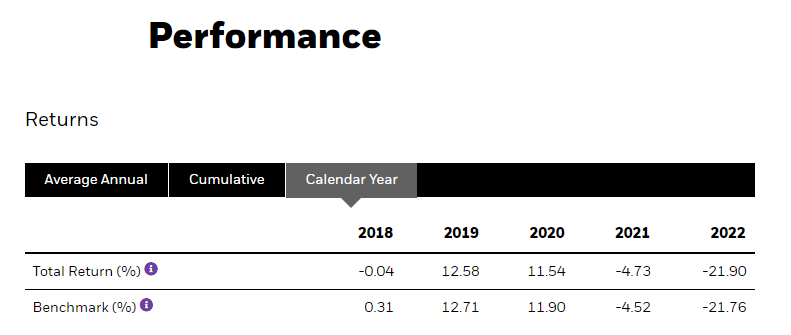

Look no further than the recent performance of Canadian real return bonds. Despite high inflation by recent historical standards, performance of the iShares RRB fund was -14.68% in 2022, with the FTSE Canada RRB index performing at -14.32%.

Now let’s try and find a comparable for this in the nominal bond realm. The best equivalent is probably some sort of long-term bond fund since the government of Canada has historically only issued 30-year real return bonds. Using a general government bond index would have very different duration because of this. Here is XLB as a comparison, a long-term Canadian bond fund. This has an effective duration of 14.83 compared to 15.83 for the RRB fund.

With a CPI of 5.9% for the 12 months preceding January of 2023 (and different securities/duration) the ~7.2 percentage point difference in performance between the two checks out.

What does this all mean? Real return bonds will help you deal with high inflation since they adjust cash flows but it will not save you from changes in discount rates from rate hikes.

An implication of what I’ve said above is that if inflation is truly “higher for longer” and central banks are done hiking rates due to concerns that they might adversely impact the economy, real return bonds are likely to be good investments given that the cash flows would adjust without drastic changes in the discount rates brought about by rate hikes, assuming the government maintains its creditworthiness.

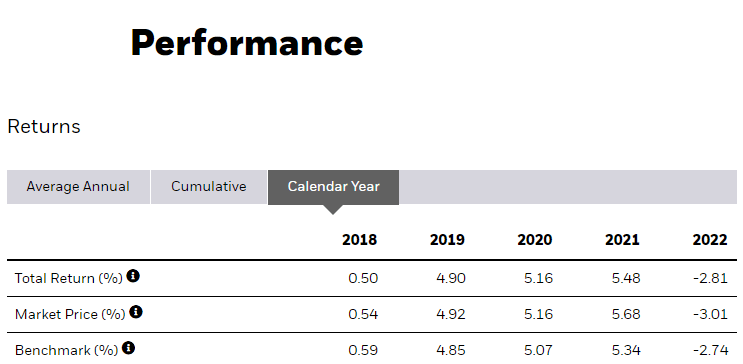

Canada has only offered long-term RRBs and, as of November, has decided not to issue RRBs anymore. But if you are worried about inflation in the US, 0-5 year TIPS ETF from iShares has actually had fairly strong performance, as shown below. But is this a hedge? Well, think about it this way. At an inflation rate of roughly 6% and a return of -2.74%, the real value of your securities went down by nearly 9%. That doesn’t sound like a hedge to me.

DISCLAIMER: I am not a financial advisor. Nothing on this website is to be constituted as financial advice. All content here is solely for educational purposes. They solely represent the opinion of the author.