The Japanese carry trade goes wrong and the global markets unwind. Volatility spikes, and as I write this, my portfolio is basically back to where it was before all this. I hold a portfolio that is almost entirely equities with a small commodities allocation. It’s diversified among multiple equity factors, but the swings in the market aren’t all that different from your standard MSCI world index or something.

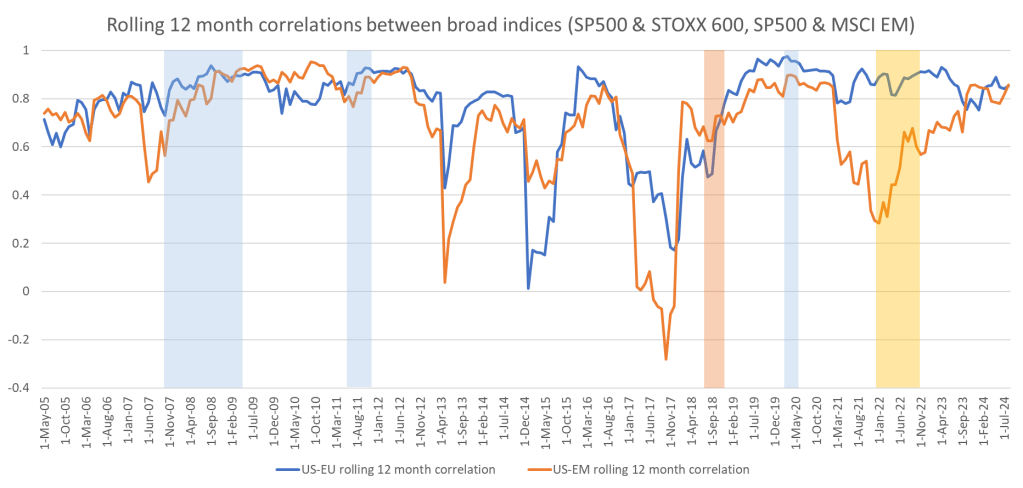

Diversification helps…until it doesn’t. I calculated the 12-month rolling correlations between the S and P 500 and the European STOXX 600 (the blue line) with the same numbers for the S&P 500 and the emerging markets index in the orange.

I’ve highlighted a few areas of the graph. These periods represent various points of market stress (the 2008 financial crisis, a short bear market in 2011 in the US, a brief correction at the end of 2018, the covid bear market and, on the right most side, the stock market struggles of 2022 as rates rose).

Correlations between the EU, EM and US regions seem to increase during these periods of market stress, going above 0.8 in many cases such as the GFC, 2011 bear market and the Covid crash. The correlations also seem to remain elevated afterwards (and since it’s after the crash, presumably they’re generally recovering together). EM seems generally to be less correlated to the SP500 than the EU, but performance in that segment hasn’t been great either as of late.

I’ll end with some thoughts from Eugene Fama that got me thinking about all this in th first place. It highlights yet another aspect of international investing that often isn’t captured in the data; international investors may face expropriation from foreign governments.

“A global market portfolio is kind of a risky venture because the problem is that countries go to war with one another. We thought we were past that, but now we’re finding out we aren’t. And wartime is subject to expropriation risks. So in other words, each side expropriates the investors of the other side, and they never get made whole after that. Everybody forgets about investors.“

While I don’t necessarily agree with another statement from Fama, below, it did get me thinking.

“Now, the volatility of the U.S. market portfolio of stocks is very similar to the volatility of the international market portfolio of stocks. There’s not much of a diversification effort that’s lost by doing it.”