LBOs have been a great asset to hold since they became popular in the 1980s. It’s common to find statistics on just how much better LBO investors have fared relative to the public market, leading to an explosion in the amount of capital in the space. You get understated volatility from the lack of mark to market plus a higher return. What’s to dislike? Capital has flooded in, so much that it can’t even be spent, as evidenced from the Preqin chart below taken from a Man Numeric research article I read.

Why would one expect LBOs to outperform the market index anyways? Well, a few things outside of manager alpha: an illiquidity premium, systematic undervaluation of private assets, leverage and sectoral differences between private markets and public ones.

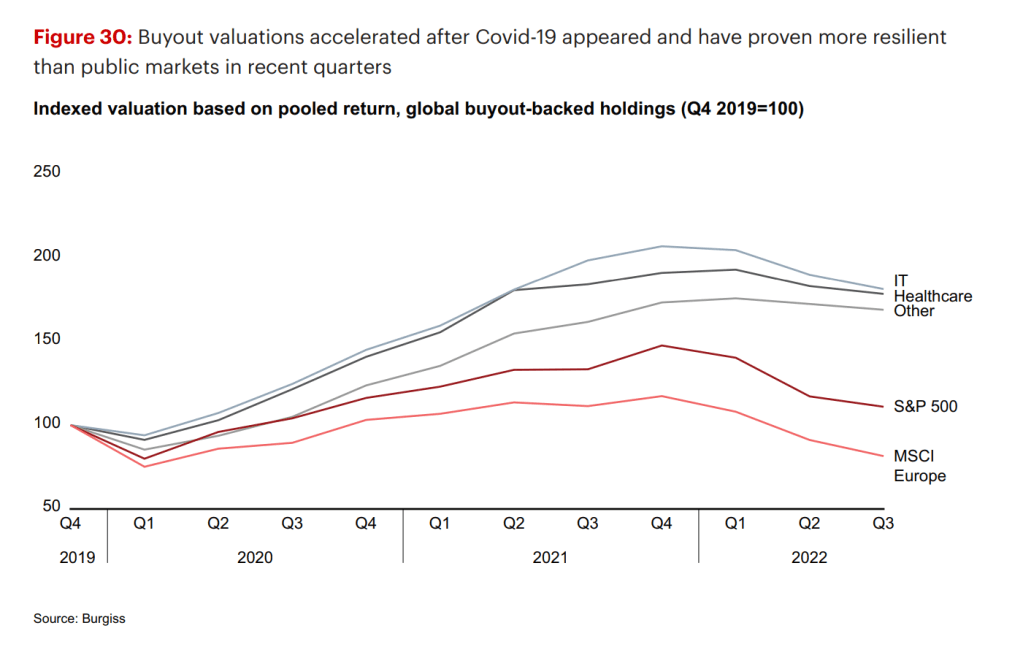

I won’t touch on the illiqudity premium. Nor will I talk about sector differences. But I feel as though both valuations and leverage may no longer as favourable for the LBO market. Bain’s 2023 PE report highlights that LBO valuations as of Q3 2022 significantly exceed that of public market ones. If I recall correctly, Steve Kaplan may have written a paper or two suggesting that LBO may, in some past periods, have had characteristics similar to that of small/mid cap value funds. However, the asset class as a whole no longer holds this (I imagine this is partially due to the populartiy of growth LBOs from certain sub-sectors like software).

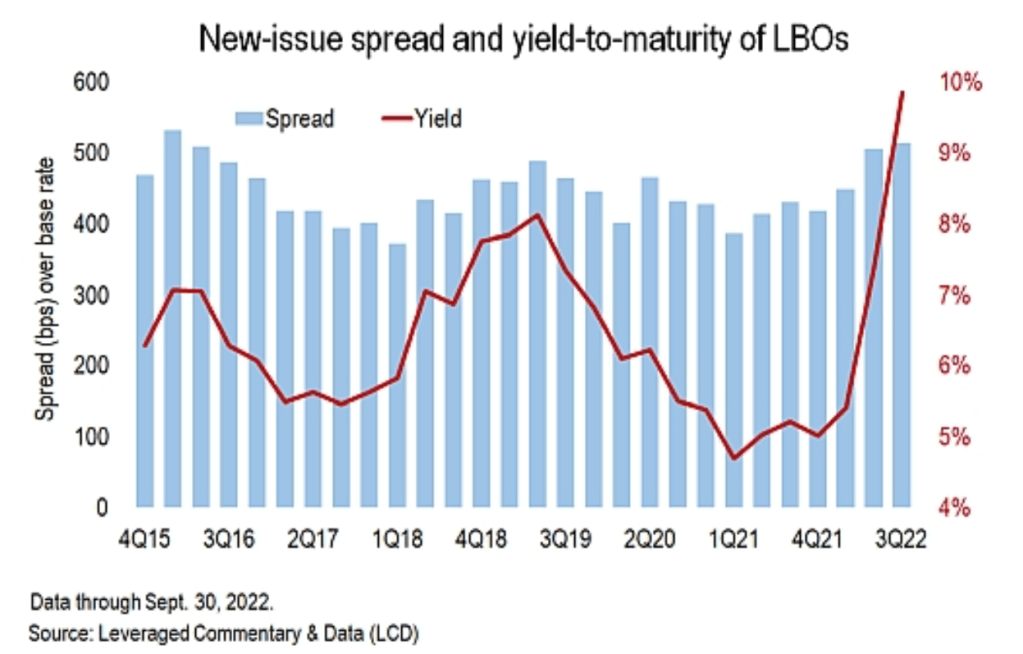

Now on to leverage. I was talking to a friend not long ago about ways to systematically beat the market. Mind you, he’s a finance PhD student. Half jokingly, I said that 1.1 times levered S and P 500 beats the S and P 500. This is particularly true for LBOs where concerns about margin calls don’t exist the way they do in public markets. But this depends on beating the rate at which you can borrow. When interest rates are dirt low and the economy is chugging along just fine (i.e, low spreads for issuers relative to the risk free rate) that’s easy. It’s harder today since both the risk free rate and the spread on LBO debt are both materially higher than they have been in the recent past.

This chart from Pitchbook LCD showcases just how much higher they are. Nearly 10 percent in 3Q22 (we’ve had a few more rate hikes since then) with a 500ish bps spread is nothing to sneer at. Maybe they can generate enough in the way of return to generate some return over the debt they take out. But I highly doubt that leverage will be as large a contributor to their excess returns over public market benchmarks in comparison to the returns we’ve seen over the last decade and a half. Particularly at these high valuations.

Does this mean that LBOs are a futile endeavor? Far from it. But it does highlight that the low hanging fruit of debt and undervaluation may not work in the favour of PE funds the way they once did. The hunt for alpha goes on.

DISCLAIMER: I am not a financial advisor. Nothing on this website is to be constituted as financial advice. All content here is solely for educational purposes. They solely represent the opinion of the author.