As a Canadian, I’m well aware that my domestic markets are a relatively small share of global financial markets as a whole. This leads to a good deal of international diversification; the majority of my portfolio consists of investments in foreign countries.

But what currency should I hold them in? This is not an easy question, nor will I attempt to fully explore it in this blog. However, I would like to highlight the reason for which I have a disproportionate amount of USD exposure in the portfolio relative to the US equities I hold in the portfolio itself.

Firstly, why not hedge it all back in to CAD? My consumption is almost entirely in CAD. I believe that stocks are not a zero sum game as economic growth can lead to long-run earnings per share growth, resulting in positive expected returns. While I have my suspicions on how currencies might fluctuate (carry trading, for instance) it just isn’t a positive sum game like stocks.

Enter leverage. I took portfolio theory a bit too seriously; I routinely lever up portfolios with relatively high Sharpe ratios as opposed to trying to pick stocks with higher expected returns. This makes me particularly averse to volatility given the possibility of a margin call.

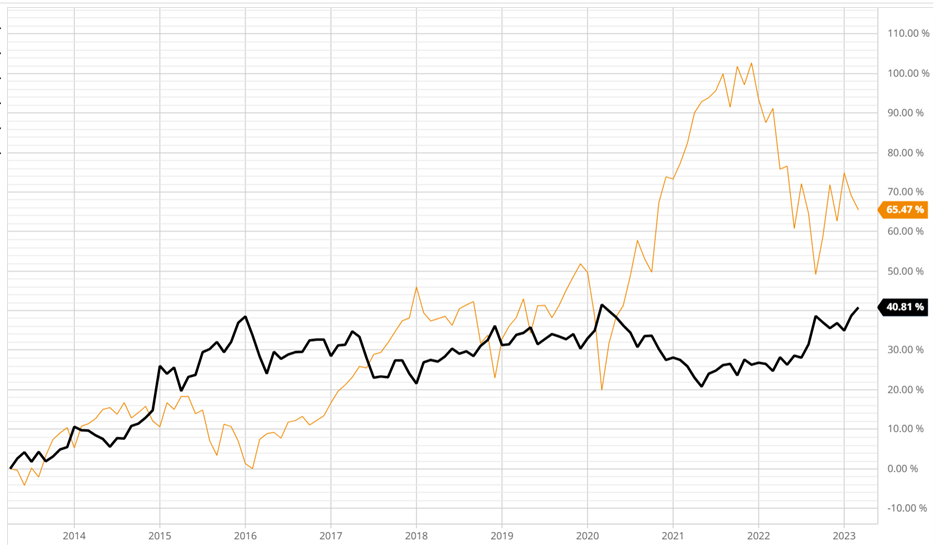

This makes the USD extremely attractive. Take a look at the chart below. The yellow line represents the return of the ACWI over the last 10 years while the black line is DLR.TO, a USD ETF on the TSX that represents the USD-CAD exchange rate. In other words, we’re comparing the CAD performance of USD to the ACWI.

Note the periods of high stress in the markets. In early 2016, March 2020 and the period from 2022 to the present all exhibit weak returns in the ACWI but very strong USD to CAD performance. I worry far less about the expected returns of my leveraged portfolio (typically between 130 and 150% net exposure) than my CAD margin calls. The fact that the USD performs during periods in which margin calls are much more likely relative to most market environments makes this currency far more important than any other foreign currency in my portfolio.

But why does this occur? More on this in the next blog.

DISCLAIMER: I am not a financial advisor. Nothing on this website is to be constituted as financial advice. All content here is solely for educational purposes. They solely represent the opinion of the author.