I’m not a professional investor. Like most people, I spend a large amount of time at work or at school. Thanks to systematic funds, I don’t have to spend much time analyzing stocks or the economy.

But that doesn’t mean I don’t think about them. I do, and at times, it leads to portfolio allocation decisions. If the value factor is cheap relative to historical standards (the value spread that Cliff Asness often points out, for example) I am tempted to overweigh this factor. More recently, I became a bit worried of inflation risks given large deficit spending during the COVID-19 crisis. I can’t say I have a great deal of wisdom in predicting inflation, but large deficits over the years and low inflation rates have often had me wondering that inflation might be around the corner, even prior to March of 2020.

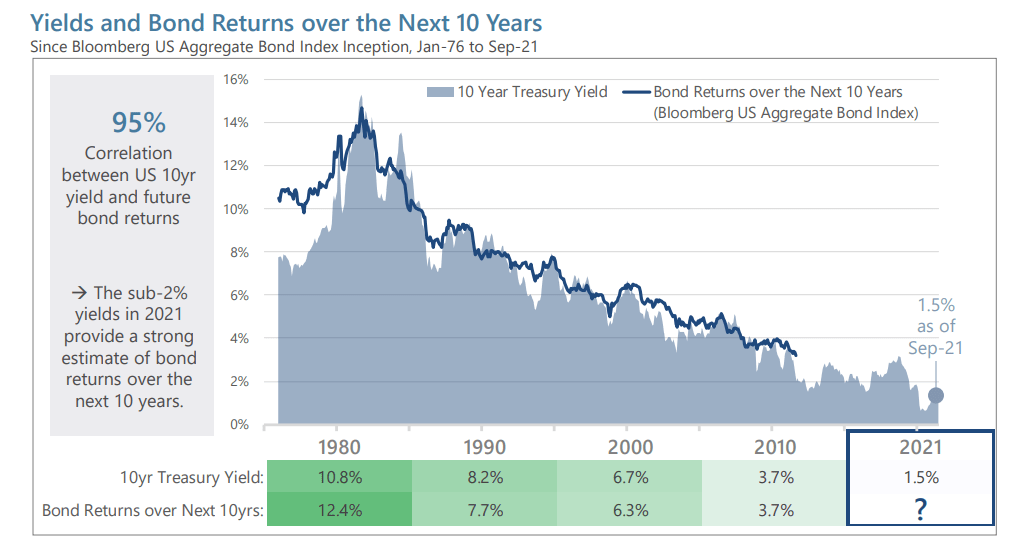

This has had implications for portfolio allocation. It’s no secret that bond yields tend to contain information about expected returns. This chart below from Graham Capital highlights the relationship between yields and the subsequent 10 year return. My own investing experience only began in 2018– well within a period of historically low rates.

And so, given yields, I committed the sin of market timing, getting rid of an already underweight position in 2020 when stocks collapsed, purchasing equities instead.

In retrospect, this turned out great. But now I had a problem. How do I deal with relatively large short-term liabilities like buying a car in a world where bonds will have low returns? Bonds became even more unattractive by 2021 as I worried that large deficits would raise the risk of inflation– a concern that ended up being warranted.

But bonds play an important role in portfolios beyond just reducing their standard deviation. I’m particularly fond of bonds in many left-tail environments where stocks see rapid declines. The “flight to safety” phenomenon means that developed market government bonds tend to appreciate. Even if I get nothing over inflation (or even certain range of negative results) it might still make sense given their tail risk hedging properties. As investors who have been raised in the world of the 60/40, we’re quite stingy when it comes to paying for portfolio insurance. But the cost of insurance might be high if inflation were to go out of control, be it in lost capital or the opportunity cost (buying small cap value in rising inflation rates + a historically large value spread in certain countries makes it far more “expensive” to buy negative return assets, but more on that later).

And thus began my consideration of low beta. I’ll have a part 2 on this to detail my convictions and skepticism of this as a solution.

DISCLAIMER: I am not a financial advisor. Nothing on this website is to be constituted as financial advice. All content here is solely for educational purposes. They solely represent the opinion of the author.