My position on this has been pretty standard on this. Buybacks and dividends are fairly similar–perhaps not perfect substitutes but not far. To the extent that I cared as to whether a portfolio company holds dividends or buybacks, it’s mostly for tax reasons. Dividends, particularly foreign ones for a Canadian investor, can be a bit painful tax wise. If I had to vote on whether my portfolio company pays a dividend or buys back shares, I’d generally prefer the former. That being said, whether companies prefer one option to another has meaningful consequences for portfolios beyond just taxes.

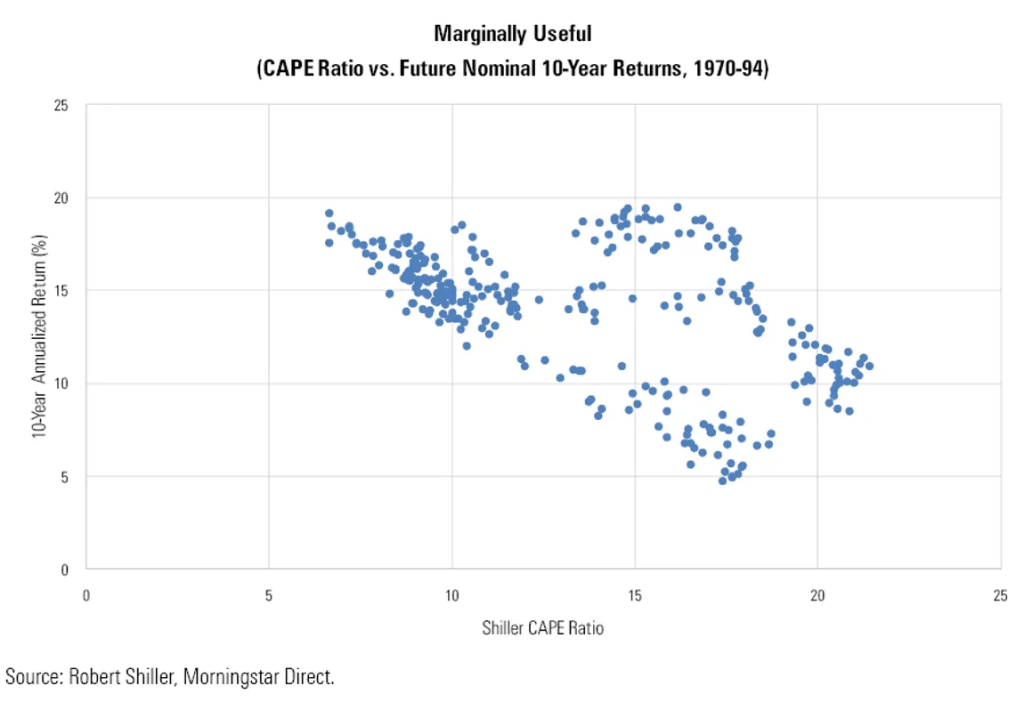

In a perfectly efficient market, we would assume that future expectations are baked in to the current price. However, we also know that there is a bit of forecastability to returns. The CAPE is probably the most commonly cited example. This chart from Morningstar visualizes the idea that cyclically adjusted price to earnings ratios have a relationship with future returns (not that this made anyone much money in the last decade or so)

The pro-cyclicality of share buybacks is markedly different from the stability of dividends, as highlighted by the CFA Institute research brief on the topic (page 9). This means that buybacks would, on average, repurchase shares at higher valuations than dividends (which would be autocorrelated and countercyclical instead, assuming the dividends are reinvested into the same company).

Value investors aside, there are implications for systematic investors and endowments as well. An interesting strategy I’ve seen Cambria Asset Management, OSAM and a few others pursue is the idea of shareholder yield. This is combines the relative substitutability of dividends and buybacks. They identify shareholder yield as a booster of returns– something that has superior performance to a naive dividend yield strategy (though I can’t seem to find a more recent backtest, this one only goes until 2013). Given that a naive dividend yield strategy has historically outperformed the market, one would expect the outperformance of the naive dividend oriented portfolio to decline as companies shift their payouts to shareholders from dividends to buybacks. Indeed, we have historically seen this as highlighted by the CFA institute (page 8)— buybacks have increasingly been preferred to dividends in the way shareholders are compensated.

Should shareholder yield be the new dividend yield strategy then? I’m not sure. Let me explain.

As mentioned earlier, share buybacks are procyclical whereas dividend yields are autocorrelated. All we have to go by in a systematic buyback strategy is historical data, as highlighted by OSAM’s methodology in the link. The relative lack of autocorrelation in buybacks compared to dividends might mean noisier portfolio construction. If a company is in the 90th percentile of dividend payers, it might not be the worst assumption to believe that it would remain somewhere around that mark the next year. I’m not certain this applies to the share buybacks. Less autocorrelation might also result in greater portfolio turnover, reducing returns.

The procyclicality of share buybacks might also make shareholder yield a more difficult strategy in downturns than naive dividend yield. Whether it’s a retiree or an institutions, holding on to a portfolio and spending the dividends during downtimes might be preferable to selling off the portfolio, given generally higher expected returns embedded in the lower market prices during these times (I’ll write my thoughts out on this one later). While a shareholder yield strategy might have similar distributions to a dividend yield one, it would probably fail to do so with the same level of diversification (unless share buybacks are far, far smaller than dividends as a method of paying back shareholders witihn the investment universe). These lower dividends might meaningfully contribute to lower performance if assets need to be sold off to meet liabilities during market downturns.

If I had to summarize my takeaways from all this reading in a sentence, I’d say that while buybacks have resulted in tax efficiency, they’ve also added some food for thought in other areas. I’ll continue thinking about dividends and their role in financial planning in the future.

DISCLAIMER: I am not a financial advisor. Nothing on this website is to be constituted as financial advice. All content here is solely for educational purposes. They solely represent the opinion of the author.